Tips for Lowering Your Auto Insurance Premiums Without Compromising Coverage

Tips for Lowering Your Auto Insurance Premiums Without Compromising Coverage

Blog Article

Unlocking Savings: Your Ultimate Overview to Budget-friendly Vehicle Insurance Coverage

Navigating the landscape of vehicle insurance policy can usually really feel overwhelming, yet comprehending the important parts can open substantial savings. Variables such as your driving history, lorry kind, and coverage options play a critical role in identifying your premium costs.

Recognizing Car Insurance Essentials

Comprehending the principles of car insurance is crucial for any kind of car proprietor. Automobile insurance coverage serves as a protective measure against financial loss arising from crashes, burglary, or damage to your vehicle. It is not only a legal need in the majority of territories yet likewise a reasonable investment to guard your assets and wellness.

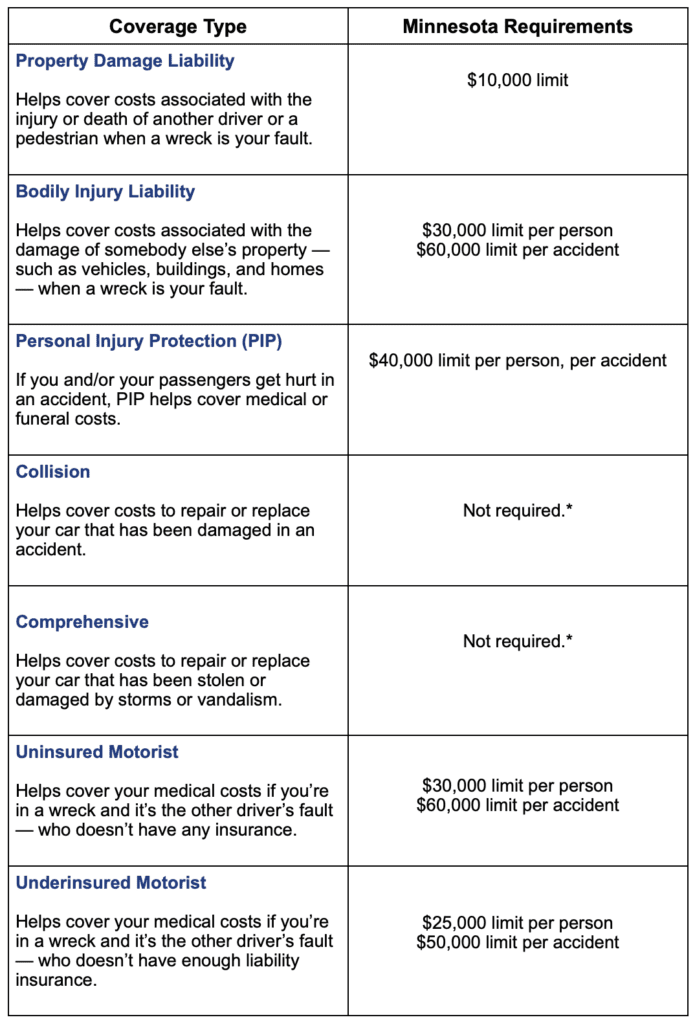

At its core, vehicle insurance coverage generally contains numerous essential elements, consisting of liability protection, crash coverage, and detailed insurance coverage. Liability insurance coverage protects you against cases occurring from injuries or problems you create to others in an accident. Crash coverage, on the other hand, covers problems to your car resulting from a collision with an additional automobile or things, while comprehensive coverage safeguards against non-collision-related occurrences, such as theft or natural catastrophes.

Furthermore, comprehending policy limitations and deductibles is important. Plan limits determine the optimum amount your insurance firm will certainly pay in case of a claim, while deductibles are the quantity you will certainly pay out-of-pocket before your insurance kicks in. Acquainting yourself with these concepts can empower you to make enlightened choices, ensuring you select the best coverage to fulfill your requirements while maintaining price.

Variables Impacting Premium Prices

A number of elements considerably affect the price of car insurance costs, affecting the overall price of insurance coverage. Among the main factors is the vehicle driver's age and driving experience, as younger, less seasoned motorists generally deal with higher costs as a result of their enhanced threat account. Furthermore, the kind of automobile insured plays a vital role; high-performance or luxury cars commonly incur higher prices due to their fixing and substitute expenditures.

Geographical place is an additional essential variable, with metropolitan areas usually experiencing higher costs compared to country areas, mainly because of boosted web traffic and accident prices. The motorist's credit rating background and asserts history can likewise impact costs; those with an inadequate credit report rating or a background of constant claims might be billed greater rates.

Additionally, the degree of coverage selected, including deductibles and policy restrictions, can influence premium expenses dramatically. Finally, the objective of the lorry, whether for individual usage, travelling, or service, might additionally determine premium variations. When seeking inexpensive auto insurance., recognizing these aspects can help customers make informed choices (auto insurance).

Tips for Reducing Costs

Lowering automobile insurance premiums is attainable via a selection of tactical strategies. One efficient method is to raise your insurance deductible. By choosing a higher insurance deductible, you can reduce your costs, though it's vital to guarantee you can easily cover this amount in the occasion of a claim.

Making use of readily available discount rates can further reduce expenses. Many insurers provide discount rates for secure driving, packing policies, or having particular safety features in your vehicle. It's smart to ask about these choices.

An additional approach is to review your credit report, as several insurer element this into costs calculations. Improving your credit report can result in More Bonuses much better rates.

Lastly, take into consideration enlisting in a driver safety and security course. Finishing such training courses usually qualifies you for premium price cuts, showcasing your commitment to risk-free driving. By carrying out these approaches, you can properly reduce your automobile insurance costs while preserving adequate coverage.

Comparing Insurance Coverage Companies

When looking for to lower auto insurance coverage expenses, contrasting insurance coverage companies is a crucial action in locating the finest coverage at a budget friendly rate. Each insurance company provides distinct policies, coverage choices, and pricing frameworks, which can significantly affect your total costs.

To begin, gather quotes from numerous providers, ensuring you maintain regular protection degrees for a precise comparison. Look past the premium costs; scrutinize the specifics of each plan, including deductibles, responsibility restrictions, and any type of additional attributes such as roadside help or rental cars and truck protection. Understanding these elements will certainly help you establish the value of each policy.

In addition, consider the reputation and consumer service of each service provider. Research study on the internet testimonials and ratings to determine customer fulfillment and claims-handling effectiveness. A service provider with a strong record in solution might deserve a somewhat higher premium.

When to Reassess Your Policy

Regularly reassessing your automobile insurance coverage plan is essential for making certain that you are receiving the most effective coverage for your requirements and spending plan. Numerous vital life occasions and modifications call for an evaluation of your plan. If you relocate to a brand-new address, especially to a different state, neighborhood legislations and risk aspects might influence your costs. Furthermore, obtaining a brand-new vehicle or selling one can modify your insurance coverage demands.

Adjustments in read the full info here your driving behaviors, such as a new work with a much longer commute, must also prompt a review. Furthermore, substantial life events, including marriage or the birth of a kid, might require additional protection or changes to existing policies.

Verdict

Attaining cost savings on automobile insurance demands a thorough understanding of insurance coverage requirements and premium influencing variables. Via thorough comparison of quotes, analysis of driving records, and assessment of vehicle safety and security functions, individuals can uncover possible discounts. In addition, approaches such as raising deductibles and regularly examining policies add to reduce premiums. Staying notified and proactive in reviewing choices inevitably makes sure access to budget-friendly car insurance while keeping sufficient defense for possessions.

At its core, car insurance coverage usually consists of numerous crucial elements, including liability protection, crash insurance coverage, and detailed coverage.A number of elements substantially influence the cost of vehicle insurance policy costs, impacting the total price of insurance coverage. By applying these techniques, you can successfully lower your vehicle insurance coverage costs while maintaining sufficient insurance coverage.

Frequently reassessing your car insurance coverage plan is important for making certain that you are receiving the best protection for your needs and spending plan.Attaining cost savings on auto insurance policy demands a detailed understanding of protection needs and premium influencing variables.

Report this page